By Brian Dugan, Managing Director at Edgemoor Infrastructure & Real Estate. Bio below. Header image: ©Architectural Fotographics/Steve Swalwell

This article discusses the “Progressive P3 model.” This model is already common in higher ed P3s, but is less common in other state, county, and municipal P3s. The article underscores the importance of leveraging this procurement model in these challenging times, both for universities and the broader public sector.

Overview and Explaining the Model

As the COVID-19 pandemic feeds concern over a potentially deep and long-lasting recession, public owners/governments and universities are increasingly seeking innovative ways to advance projects in order to help put people back to work, revitalize their local economies, and gain access to stimulus funding. We saw a similar trend following the 2008 Recession, when public agencies raced to tee up “shovel-ready” projects to capitalize on federal stimulus money and boost their economies. At the same time, public sector budgets are being slashed as revenue projections are reduced; thus, investing in a long, resource-intensive, and expensive procurement for a capital project is not appealing and may not be feasible.

In parallel, the private sector’s appetite to invest in pursuing projects with lengthy, expensive procurements is waning. This has been driven in part by a growing belief that investing millions at-risk in long and expensive fixed-price, committed-financing P3 procurements in which the shortlisted teams have a 25-33% chance of winning the project is a challenging business model. COVID-19 is also straining company resources, making such an investment challenging or impossible.

This is where the Progressive P3 procurement model comes in.

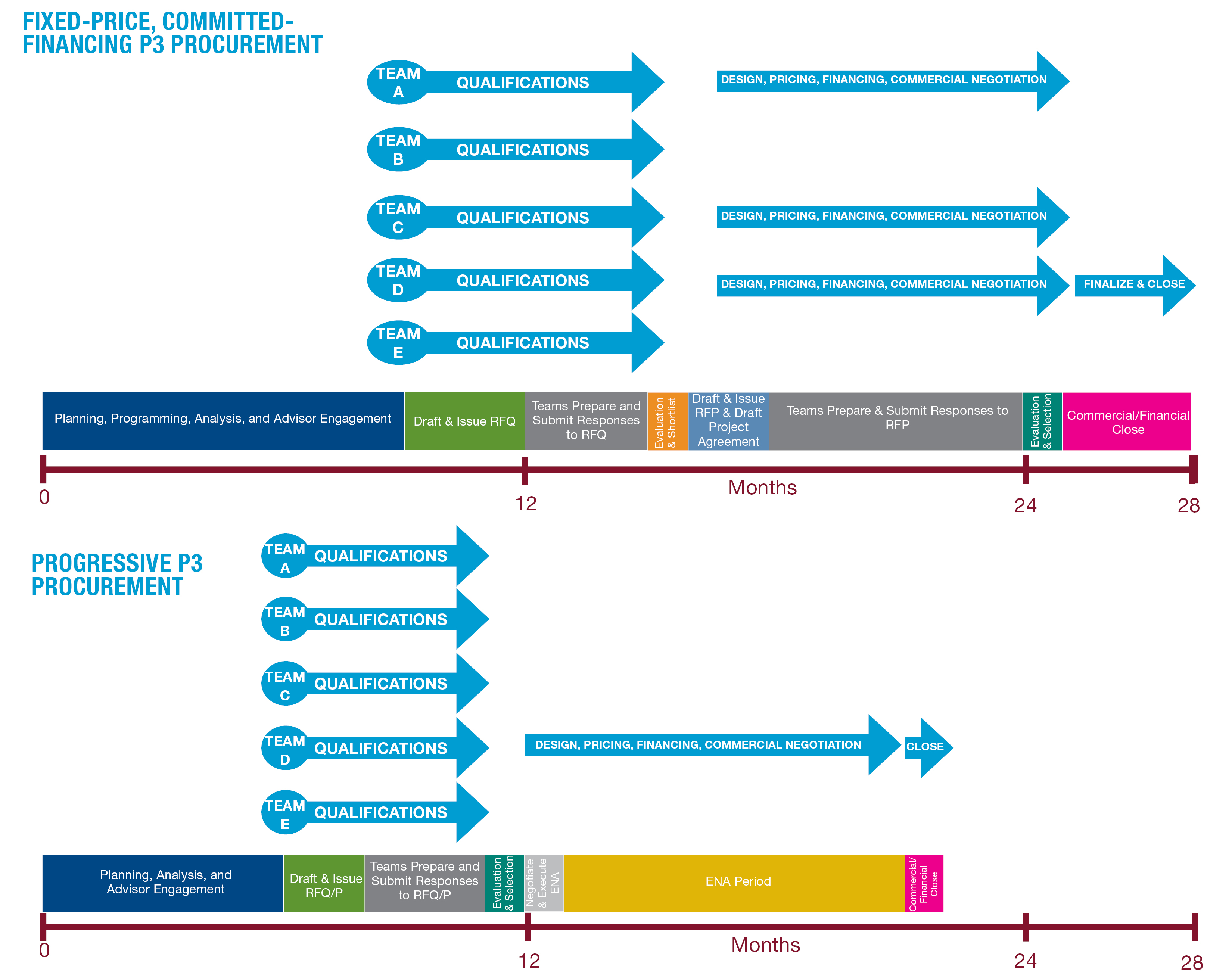

The Progressive P3 model is designed to utilize the innovative P3 project delivery and maintenance model while allowing the procuring authority to pick a partner faster, invest less resources and money in the procurement, and have more influence on early conceptual design than in a more traditional fixed-price, committed-financing P3 procurement. It also saves the bidding teams time and money.

In a Progressive P3 procurement:

- The procuring authority selects a team based largely on qualifications and, potentially, a concept design and indicative budget, choosing the team that is best positioned to deliver the project based primarily on the firm’s track record of success and key personnel.

- Once selected, the development team closely collaborates with the public authority to develop design, estimate costs, and efficiently allocate risks, all in a very transparent manner.

- If financing is included in the delivery model, the process of refining the financing structure/selecting lenders is advanced in parallel to design. This period of initial design development and financial structuring is usually governed by an exclusive negotiating agreement (ENA), often taking the form of an interim agreement or pre-development agreement.

- Design is progressed to 30-60% or until a price is agreed upon between the selected team and the authority, after which long-term contracts are finalized and financial close is achieved.

A Progressive P3 essentially combines progressive design-build with the finance, operations, and maintenance scopes typically involved in P3 delivery.

Challenges to Fixed-Price, Committed-Financing Procurement

Most public capital project procurements typically involve price competition within the selection process. Respondents to a design-build RFP advance design to a sufficient level to enable them to confidently guarantee a price to complete the design and build the asset. In addition to fixing and guaranteeing the design-build delivery costs, in a fixed-price, committed-financing P3 procurement, bidding teams often need to fix their prices for operations & maintenance (O&M) for 30+ years, as well as source legally-binding financing commitments from lenders for the project. This approach presents several challenges for both procuring agencies and bidding teams:

- It requires significant time, staff, and expense for the authority to prepare and manage a fixed-price, committed-financing procurement. For the procurement to run smoothly, a best practice includes engaging qualified technical, financial, and legal advisors, typically in advance of issuing an RFQ. The project must be sufficiently defined so that respondents have the detail needed to price the project and the authority can ensure it is comparing apples-to-apples bids. Additionally, significant stipends payable to the shortlisted teams that are not selected are often required to entice teams to bid and improve competition.

- In parallel, bidding teams responding to an RFQ and RFP under this procurement model need to invest significant time, staff, and expense. Bidding teams need to engage an even larger team of consultants/advisors (e.g. sponsor’s counsel, lenders’ counsel, financial advisor, insurance advisor, lenders’ technical advisor, financial model auditor, tax and accounting consultant, etc.) to prepare and help negotiate numerous contracts (project agreement, design-build agreement, facilities management agreement, coordination agreement, lender commitments, etc.) before a proposal can be compliantly submitted in response to the RFP.

- Given that the procurement is governed by a structured communication protocol to ensure fair competition, the authority and stakeholders may not be able to provide comprehensive feedback on the bidding teams’ designs until a winning team is selected, at which point design has already been advanced to 20-30% of construction drawings. Thus, the authority and stakeholders lose some degree of control over early design concepts, and authority-directed changes post-award may result in costly change orders.

- While a fixed-price, committed-financing P3 procurement provides cost certainty at selection, bidders’ prices typically include significant contingency because bids are submitted before design is complete. In addition, if the risks have not been most efficiently allocated in the project agreement, bidders may include additional contingency to address these risks.

Benefits to Progressive P3 Procurement

Progressive P3 procurements are structured to overcome these challenges but still utilize the innovative P3 delivery model. Namely, they are faster, less costly, and allow the authority more control over design.

Many believe they also result in more efficient pricing. In a progressive process, the selected team continues to reduce contingency as design advances and risks are better understood until the guaranteed price is set. Contingency may be reduced from 8-10% in a hard-bid to 3-5% in a progressive model.

Additionally, costs are built up in a transparent process, and subcontractors competitively bidding on design packages know they’re bidding to the team that has been selected for the project, and not to one of three or four shortlisted teams. This bidding dynamic – with subcontractors being one step away from winning the work, rather than two – motivates the subcontractors to bid aggressively. Similarly, a competitive process takes place with debt lenders, and, when lenders know they’re providing financing terms and pricing to the winning team, they are likely to sharpen their pencils. For the developer, it is easier to get the focus of the subcontractors and lenders as “one of one” rather than “one of three.”

Projects that need to move quickly but require more scope definition, exploration of various alternatives, environmental/entitlement permitting, and/or significant stakeholder input in the design, or that are at risk for major changes during the procurement, are well suited to progressive procurements.

Controlling Costs

An often-voiced concern over Progressive P3 procurement is the lack of cost certainty at award. However, in the progressive approach, the public authority typically prescribes a target price or affordability limit pre-selection, and, if costs come in over that limit, the procuring authority has several options: it can modify the project scope, decide to cancel the project, increase the budget, or initiate negotiations with the second-place team. There are other tools authorities can utilize to improve price certainty at award but still save significant costs on the procurement. For example, certain fee percentages, unit prices, and overhead costs that may be unrelated to design can be bid. Another option is to run more of a hybrid procurement wherein the authority requires design-build and O&M pricing but not committed financing. Avoiding the committed financing workstream alone can be a big cost saver.

Trust Is Key

A strong foundation of trust between the parties is critical to a successful Progressive P3. Without trust, changes in cost and risk allocation that may occur during design development can create conflict. Realizing the paramount importance of trust in the progressive process, the procuring authority typically focuses on trustworthiness and track record when evaluating teams, usually leading to the selection of a proven private partner and a successful long-term partnership.

ENA Period

Key to fostering trust between the parties is an early effort to align objectives, set expectations, and agree on decision-making processes. The results of this effort are memorialized in an exclusive negotiating agreement (ENA) that is executed shortly after selection and governs the period of collaboration between selection and commercial close. The ENA may also be called an interim agreement, pre-development agreement, or something else entirely. However, they all generally aim to accomplish the same goal: provide the parameters within which the design can be collaboratively developed to reach a guaranteed price, after which the longer-term project agreement can be executed and replaces the ENA. In addition to design development and project agreement negotiations, the ENA may govern the advancement of other activities such as feasibility analysis, environmental and geotechnical studies, permitting, and financial structuring. The ENA typically provides for the reimbursement by the authority to the private partner for certain costs such as advancing design and other necessary workstreams. If the authority decides to not move forward with the private partner or project, it then owns the design and other work produced by the private partner during the ENA period in exchange for the reimbursement.

Success Stories

There are numerous recent examples of the progressive approach being deployed successfully to deliver landmark infrastructure projects in the US.

- University

©Architectural Fotographics/Steve Swalwell of Kansas Central District Development, Lawrence, KS – The University of Kansas utilized an interim agreement with a consortium led by Edgemoor Infrastructure & Real Estate to finalize the program, advance design, and reach commercial and financial close in January 2016, within seven months of selection in June 2015. The $383 million project delivered in May 2018, two months ahead of schedule, and is now operational. It includes a 285,000-square-foot integrated science facility, 26,500-square-foot student union, 1,250 beds of student housing in three buildings, dining center, athletic fields, and 2,000 parking spaces, as well as a central utility plant and all utility and transportation infrastructure.

- Long Beach

© Skidmore, Owings & Merrill LLP | Fotoworks/Benny Chan, 2020. All rights reserved. Civic Center, Long Beach, CA – Long Beach leveraged the Progressive P3 model to finalize the associated environmental permitting required under the California Environmental Quality Act (CEQA) and related land sales, along with design, pricing, and the commercial terms, for its new civic center. To accommodate these processes, this 14-month ENA period ran from January 2015, shortly after selection of the Plenary-Edgemoor Civic Partners (PECP) consortium in December 2014, to commercial and financial close in April 2016. The ENA originally anticipated closing in June 2016, but PECP and Long Beach were able to reach the milestone two months earlier. The complex $513 million project, which encompasses nearly 620,000 square feet divided among the four structures and spread across six city blocks, achieved Occupancy Readiness on June 29, 2019, two days ahead of schedule.

- Travis County

Image courtesy of Hunt Companies Civil and Family Courts Facility, Austin, TX – Travis County followed a progressive process with an ENA that allowed the county to move the 430,000-square-foot, $344 million courthouse project from selection of a consortium of Hunt, Amber Infrastructure, and Chameleon Companies in July 2018 to financial close in April 2019, a period of nine months. Respondents to the County’s RFP submitted a high-level concept design, indicative construction pricing, certain fees, and a plan of finance. Design, pricing and contractual terms were then collaboratively advanced, and ultimately finalized, between the consortium, the County, and their advisors during the ENA period. Having the ENA period allowed the developer to transparently compete the debt and construction trades at the optimum time, enabling Travis County to fully transfer development and completion risk with minimum contingencies.

These are just a few of the many projects that have validated the merits of the Progressive P3 procurement model. Now, with COVID-19 straining budgets and increasing authority interest in teeing up “shovel-ready” infrastructure projects to revitalize the economy, put people back to work, and access stimulus money, the Progressive P3 model has become an even more attractive procurement option.

BRIAN DUGAN is a Managing Director with Edgemoor Infrastructure & Real Estate. Edgemoor is a leading developer of public buildings and infrastructure, having delivered approximately $2 billion P3 projects across the U.S., with another $2 billion currently under construction or in development.

Mr. Dugan has extensive experience in project finance and development, with a track record of success working with the public to overcome complex challenges through creative P3 solutions. At Edgemoor, he is responsible for identifying opportunities, analyzing feasibility, forming strategic pursuit partnerships, structuring project financing, sourcing debt and equity, negotiating contractual arrangements, and executing/managing projects.

Mr. Dugan holds a Masters of Business Administration from the UCLA Anderson School of Management and a Bachelor of Science in Finance and Marketing from the University of Virginia McIntire School of Commerce.