The Opportunity Zones program is an economic development tool enacted as part of the 2017 Tax Cuts and Jobs Act. The goal of the program is to encourage long-term capital investment in economically distressed communities via substantial federal tax breaks (e.g., temporary tax deferral, tax reduction, and tax exemption). These communities, defined as having a poverty rate at least 20 percent, have generally been hard hit over the years due to job losses, and may not be seen as investment-worthy as other areas. The Opportunity Zones program seeks to shift the equation, making these urban, suburban, and rural communities appealing to investors looking to receive favorable tax treatment on their capital gains tax liabilities.

While colleges and universities are therefore not intended as the main beneficiaries of the program, there is opportunity here nonetheless for schools to benefit. It just has to be the right development in the right place with the right partners. Schools will also find that Opportunity Zones may be a new way to engage alumni looking to support their alma mater.

This article serves as a primer on Opportunity Zones, and will become part of a series of articles addressing this new program.

Where are Opportunity Zones located?

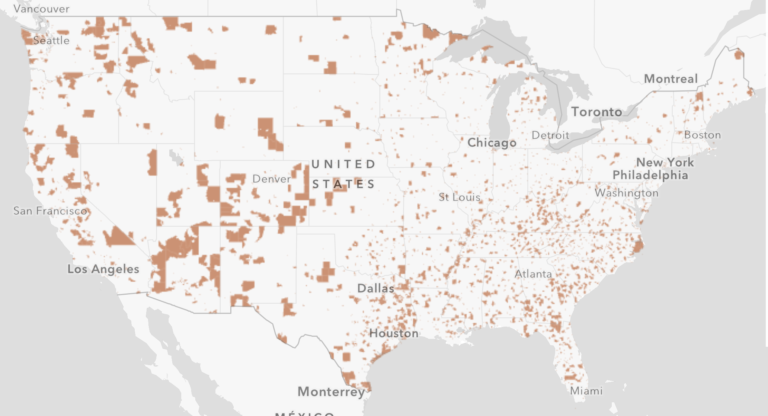

The physical regions defined as Opportunity Zones are economically distressed communities and adjacent census tracts meeting certain criteria and as nominated by governors. Since June 14, 2018, the U.S. Treasury has officially designated 8,767 census tracts as Opportunity Zones across all 50 states, all territories, and Washington, DC, within which approximately 35m people live. The approved tracts will remain approved for 10 years (through December 31, 2028), and no new tracts may be added to the approved list during this time. A map of these designated opportunity zones, a complete list of the census tracts, and additional information can be found on the Treasury’s Community Development Financial Institutions Fund site.

Some approved Opportunity Zones include, border, or are near schools. The Wall Street Journal reported early on that areas dense with students can qualify due to students’ low-income status. For example, some of California’s initial Opportunity Zones include parts of Stanford University; San Diego State University; and University of California, Berkeley. Many other colleges and universities will find—sometimes to their own surprise—that they are included in or adjacent to Opportunity Zones.

To see if your school is located in or near an Opportunity Zone, plug your address or zip code into this interactive map from Economic Innovation Group—the think tank that first developed the idea of an Opportunity Zone in 2015.

Who can invest in Opportunity Zones? What are Opportunity Funds?

Individuals and businesses—which is to say, not schools—can invest in these zones. Schools can still benefit, however, as described below.

Individuals and businesses are eligible to receive the aforementioned tax benefits when investing capital gains generated from prior investments into Opportunity Funds. These funds then get redeployed in Opportunity Zones.

Opportunity Funds are an investment vehicle organized specifically for the purpose of investing in an Opportunity Zone. They can be organized as corporations and partnerships, but must be private-sector entities that invest at least 90 percent of their resources in qualified Opportunity Zone property. Funds can be of any size, and can oversee anything from a single project to a city to a whole state or even multi-state region.

Ultimately, funds can be used to create new businesses, new commercial real estate, new residential real estate, or infrastructure. In limited cases, funds can also be used to invest in existing businesses and existing real estate, as long as the investment level is substantial enough. Some limitations do exist, for example Opportunity Funds may not invest in what are defined as “sin” businesses (e.g., golf courses, massage parlors, gambling facilities, etc.).

What do states hope to get out of Opportunity Zones?

The hope is to catalyze new businesses and commercial projects in economically distressed communities. That might look like an increase in affordable and workforce housing, new amenities (e.g., retail), infrastructure, start-ups, or new jobs for local residents.

Some states have developed visions for what the program, specifically, should contribute to the geographical region—for example support for transit-oriented development, dovetailed efforts surrounding pre-existing revitalization projects, or encouraged development in rural areas. Certain states and municipalities are offering additional incentives to Opportunity Zone projects as well, in order to increase their appeal to investors.

It is easy to see how, in many cases, the intention/goal aligns with what a college or university might be looking to do or contribute to in their communities. Perhaps a workforce housing project could also offer faculty/staff housing, new amenities and infrastructure could strengthen town-gown relationships or the campus-edge, or start-ups might be part of an innovation campus that the school partners on (see the University of Delaware example below). The development in opportunity zones can take on a huge number of forms—many of them beneficial to schools.

What do investors get out of the program? How does this apply to alumni?

Significant savings on federal taxes—including tax-free income. Investors may reinvest/rollover capital gains from any prior investments into an Opportunity Fund. These capital gains can come from the sale of a variety of appreciated assets, including stocks, real estate, art, and collectibles. Depending on the length of the investment, investors benefit from deferred and reduced capital gain taxes, and potentially the ability to completely avoid any capital gains tax on certain gains realized by the Opportunity Fund they are invested in.

Because individuals can create and invest in Opportunity Funds, schools might consider reaching out to alumni about the opportunity. These funds are not just a way for alumni to park their money in a tax advantaged way while interest rates rise, but to also simultaneously support their alma mater. While most taxpayers will not have enough capital gains to make a full project possible (e.g., the design and construction of a new mixed-use development), investors can pool resources. Pooling introduces complications such as shared governance, but also means lessening the risk to any one individual investor. And while there are definite limitations to who can invest what type of money into what type of fund, overall there is ample opportunity for an alumni to engage with their alma mater in this way.

How can schools, specifically, benefit from the resultant boost to development?

Investors looking to take advantage of the preferential tax treatment created with the Opportunity Zones program are looking for opportunities to invest. Schools might partner with these investors and the resultant organizations to spur development on or adjacent to campus.

The University of Connecticut, for example, recently announced a partnership with the Town of Mansfield and the Connecticut Economic Resource Center, Inc. to educate potential developers and private investors about the Opportunity Zone in Mansfield, which is adjacent to the school. The partners’ goal is to attract new business and capital investment to the zone, and they recognize the importance of having a major anchor institution as part of attracting development.

In a forthcoming article on the Higher Ed P3 Resource Center, we will also detail how the University of Delaware (UD) is using an Opportunity Zone to help create its STAR Campus—a science, technology, and advanced research innovation campus half a mile from UD’s primary academic campus. This project is revitalizing the entire region while providing a host of benefits to the school, including enhancing and leveraging the university’s research capabilities. A lot of this development is taking place via public-private partnerships (P3s), though certainly not all.

Additional Resources

- The IRS’s FAQ on Opportunity Zones

- Local Initiatives Support Corporation’s list of states and how each is approaching Opportunity Zones

- Enterprise’s overview of Opportunity Zones